In Times of Uncertainty, Investors are Hungry for Information— from their Advisors

When it comes to managing their finances, your clients are hungry for information. They want to know they are making the right decisions about their investments and their future. In times of uncertainty—from market turmoil, rising rates, or geopolitical upheaval—the desire for information is even greater.

Regular communications are one of the easiest ways you can build and strengthen the relationship you have with your clients. Whether you are offering proactive updates about their finances, timely insights about current market conditions, or simply demonstrating understanding with a personal message, every touch point serves to strengthen your relationship and build trust.

Advisors Are the Go-To Resource for Investors

Clients turn to an advisor for a wide range of reasons. Some are looking to tap into demonstrated financial expertise to help them make decisions. Others want to delegate the stress of making day-to-day investment decisions. And some simply don’t have the time to manage their finances themselves.

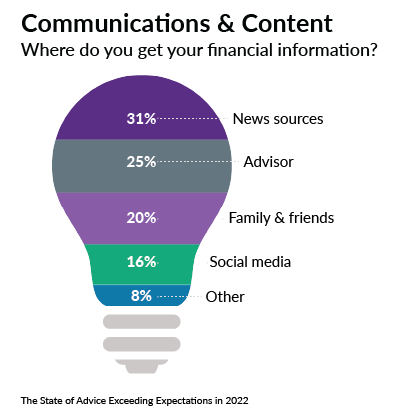

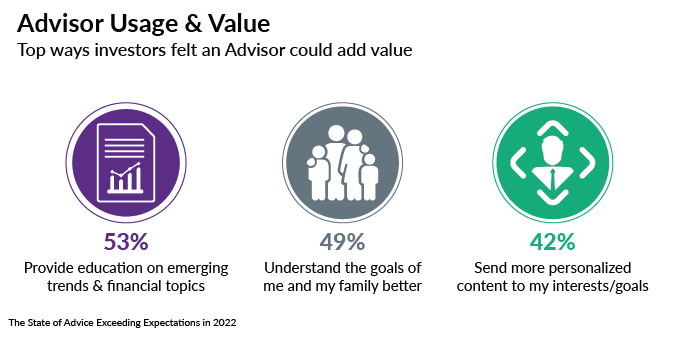

One common trait among these clients is the value they see in the time they spend talking to and working with their advisor. You are one of the primary sources of financial information for your clients. They turn to you with questions and are looking to you to provide advice and guidance about their finances, investing and the markets. You are also seen as a trusted resource—one that provides unbiased and value-added insights at a time when reputable information is increasingly hard to come by.

Not All Information Sources Are Created Equal

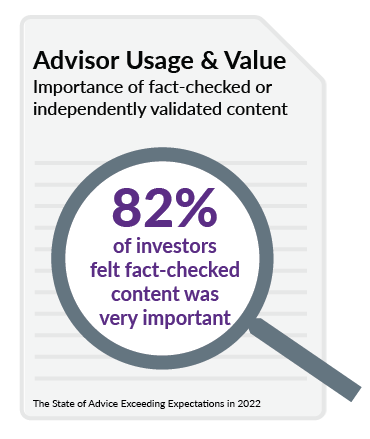

Clients are getting information from a variety of sources in addition to their advisors, including news sources, friends and family, and social media channels. While much of this information is accurate and insightful, in today’s digital world, unfounded and biased information can be amplified. Even informed consumers can sometimes have a hard time distinguishing between legitimate insights and misleading content that has been designed to appear to be from a reputable source.

As a trusted source of information, you can use the information overload of the modern world to your advantage.

Consider how you can deliver content to clients to educate them and calm their fears. Serve as a trustworthy guide and share only content from sources you know to be unimpeachable. And demonstrate your independence by sending communications that serve to educate clients or offer straightforward assessments of the economy or market trends.

You can also go further. Clients are hungry for personalized touchpoints. Think about how you can share educational information and advice. By tying the content back to your client’s goals, you can help them put the information in a personal context.

Regular Communication Fosters a Lasting Client-Advisor Relationship

Most advisors understand the power of communicating with their clients, but many underestimate their clients’ desire for regular, personalized communications. When asked, clients were more likely to say they expected their advisor to communicate with them weekly versus monthly or quarterly.

Beyond fostering a strong personal relationship between you and your clients, regular communication can also strengthen the financial guidance you offer. By offering timely information and insights, you can actually help clients make better financial decisions. Other important benefits of frequent contact include:

- Reducing client stress. Client stress often rises in line with volatility in the market. Uncertainty on Wall Street can create uncertainty for clients. Sending timely insights that explain what’s going on in the markets and dispel misconceptions can go a long way to helping alleviate client stress.

- Taking out the emotion. It is only natural for clients to want to take a step back when markets are down. Educational content can help them understand the impact of rash decision-making. You can also use personal communications to remind clients of their long-term goals and plan, helping them make investment decisions that are grounded in facts, not emotions.

- Helping clients feel understood. In addition to market commentary and educational materials, clients also want to know that you are looking out for their specific needs. Communications that are relevant and clearly tied to the goals you have discussed or events happening in their lives can help demonstrate your deep understanding of their needs. It can also further demonstrate your role as a go-to resource for all their financial concerns.

And in uncertain times, regular communication can multiply these benefits. Communications from a trusted advisor can help counteract the negative news cycle or an uptick in misleading information that is being amplified through other sources.

Successful Communications Require the Right Partner

Delivering the right content to your clients takes dedicated effort and resources. Some advisors hire a team member to focus solely on client engagement. Others opt to outsource these responsibilities to a proven third-party provider.

In a time when clients are receiving more types of content from more sources every day, it’s imperative to find a partner who provides content that stands out. You need a provider who adds value for your clients and your business—one who can help you with content solutions that are:

- Automated. Look for a provider who makes it easy to send personalized and relevant content to clients and prospects. They should offer a rules-based system that lets you “set it and forget it,” while still giving you the flexibility to send information on demand.

- Authoritative. Seek out providers who offer content that conveys deep industry knowledge and forward-looking expertise. The content they offer should be produced either by in-house experts, including attorneys, tax professionals and industry insiders, or come from established, reputable news providers.

- Accessible. Make sure you can give clients more of what they want, with easily digestible content in multiple mediums, including blogs, articles, infographics, white papers, and videos. And be sure that you have the flexibility to personalize the mix as client preferences change.

Insightful, informative communications can be a key differentiator for you and your practice. Taking the time to put in place the right communication strategy can help you reinforce your credibility, deepen relationships, and acquire new clients.

Data in this article comes from a joint survey by Broadridge Financial Solutions and Dow Jones, conducted in early 2022. Over 1,200 investors were surveyed from across the United States, Canada and the United Kingdom. The survey explored the evolving needs of investors, how they perceive the value of financial advice and the opportunity for advisors to provide value.

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your request has been successfully submitted. A representative will contact you shortly.